carbon tax benefits and disadvantages

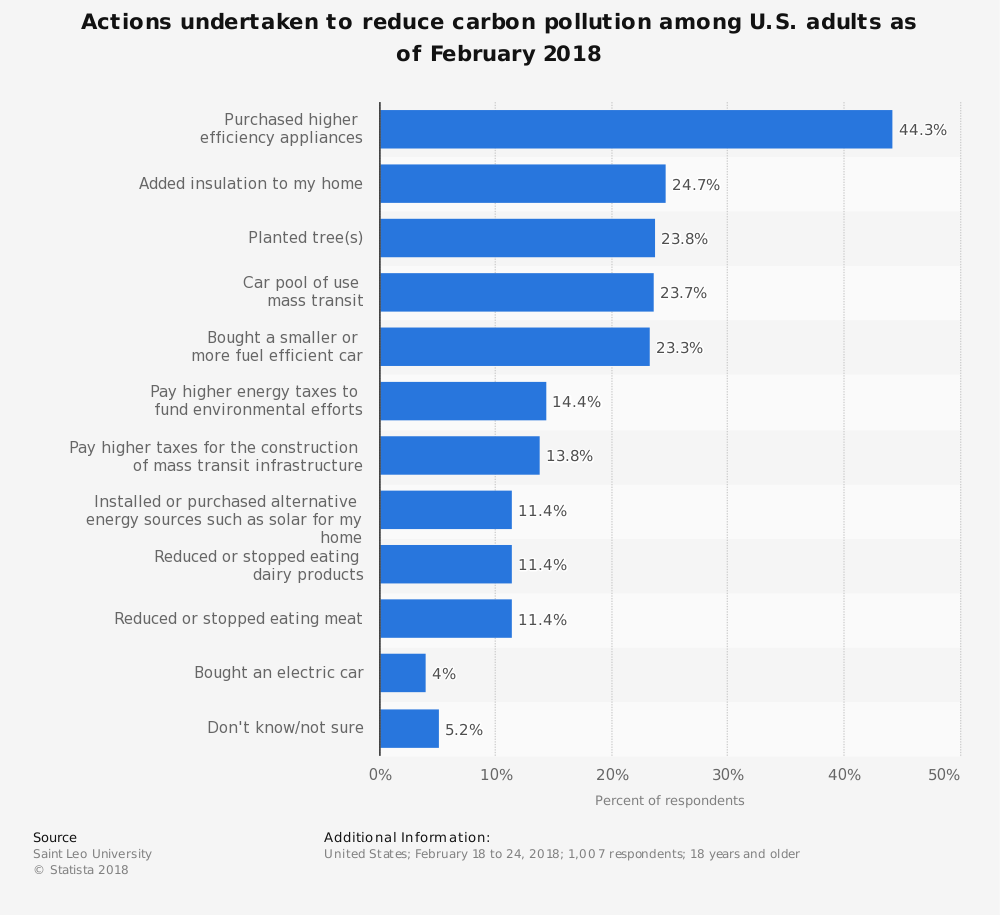

High prices for carbon-emitting goods reduce demand for them. It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue.

Carbon Tax Pros And Cons Economics Help

One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets.

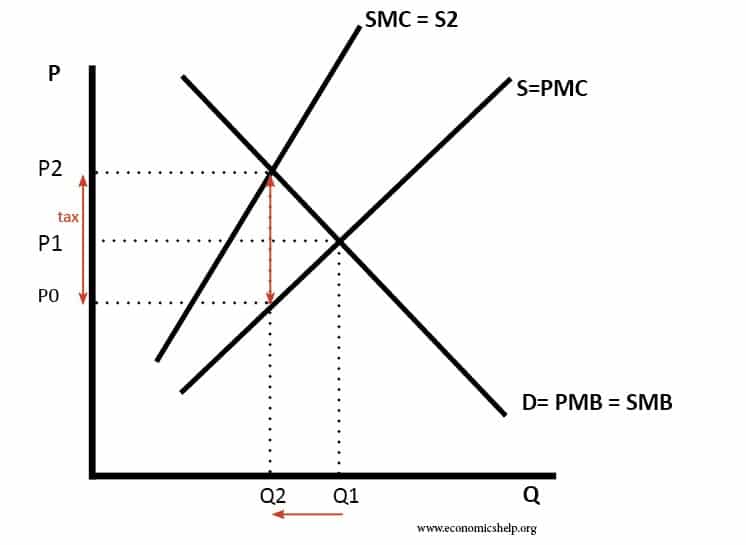

. The market price is P1 but this ignores the external cost of pollution. Studiesincluding those coming from carbon tax proponentscarbon taxes slow economic growth unless a large portion of the tax revenue is allocated to corporate tax reductions. A number of disadvantages of carbon taxes are.

That may sound a little wonky but she added that she and many. Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants. Whats worse if sufficient funds were not available at their disposal.

Some countries have already adopted such a tax and discussions are ongoing in others. Carbon tax as a reflection of societys willingness to pay to reduce the risk of potentially very expensive damage in the future. The carbon tax is generally levied on fossil fuels.

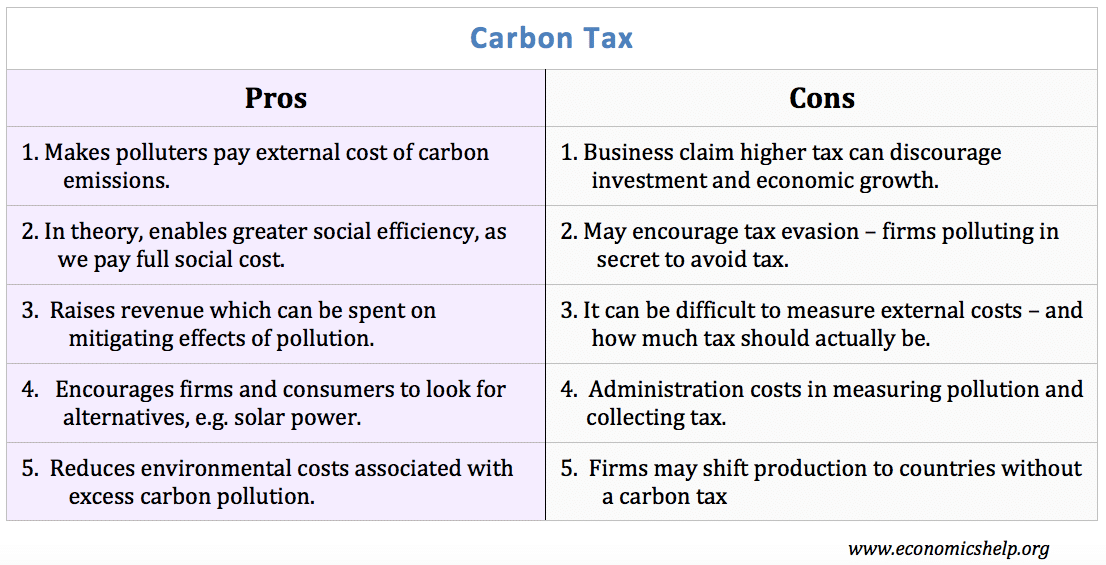

Up to 24 cash back List of Disadvantages of Carbon Tax 1. Negative net social benefits. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources.

The Congressional Budget Office estimates that with a tax of 25 per metric ton of CO2 emissions would be 11 lower in 2028 than currently projected. As Camila Thorndike the dynamic young leader of an effort to get a carbon price passed in Oregon told the Democrats at their platform hearings As a cross-sector and market-based solution a carbon tax empowers business to profitably transition to the clean-energy economy. A carbon tax can be very simple.

Many companies cant reduce their emissions as much as theyd like to. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint. The revenue could be used to.

Effects of a Carbon Tax on Labor Investment and Output 7. In that same timeframe this tax would also generate an estimated 1 trillion. There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions.

Lawmakers could increase federal revenues and encourage. Carbon taxes have been suggested as a way to internalise the negative externality of carbon emissions. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax.

Carbon offsetting has benefits at both ends of the process. Advantages of Carbon Taxes. Although the carbon tax has some important advantages it also implies some problems.

They cost lower income families more to implement on their own. However there is a view that industrial units may shift to countries with lower or no carbon taxes. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

A carbon tax also has one key advantage. Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere.

The tax would help reduce US. It imposes expensive administration costs. Tax on carbon will induce firmsplants to push for green production processes in addition to raising revenue which can be used to promote environment-friendly initiatives.

A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output. That money could help offset energy costs for low-income families fund clean energy infrastructure help us adapt. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage.

The voluntary carbon offset credit market has the potential to play a major role in allowing society to continue to emit greenhouse gases while striving to keep global warming under 15 degrees. Emissions but would have only a modest effect on the Earths climate without a worldwide effort. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

The carbon tax can be really expensive considering that the government would need a substantial amount of money for its implementation. It is easier and quicker for governments to implement. In households with low income the use of high emissions like heating homes and driving in public transportation often accounts for greater percent of the households income than in households with higher incomes.

Generally a carbon tax would increase the cost of burning fossil fuels thus increasing the cost of producing goods and services that rely on those inputs particularly for carbon-intensive things like electricity and transportation. Effects of a Carbon Tax on the Economy and the Environment. A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions.

The Pros of Carbon Offsetting. The Proposal This paper proposes a tax starting at 16 per ton of CO 2-. Determining the Tax Rate That Best Balances the Benefits and Costs of a Carbon Tax 17 The Timing of Action 18 About This Document 20 Figure 1.

A carbon tax could replace many such inefficient environmental and energy policies. The Benefits and Drawbacks of Carbon Offsets.

27 Main Pros Cons Of Carbon Taxes E C

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Advantages And Disadvantages Of Different Modes Of Transport Logistics Management Logistics Transportation Transportation

Spiral Model Advantages And Disadvantages Advantages And Disadvantages Of Using Spiral Model A P Spiral Model Software Development Life Cycle Risk Analysis

Carbon Tax Pros And Cons Economics Help

Smart City Advantages And Disadvantages The So Called Smart Cities Have Utili Smart City Renewable Sources Of Energy Information And Communications Technology

Advantages And Disadvantages Of Biomass Energy List Of Various Pros And Cons Of Biomass Energy A Plus To In 2022 Biomass Energy Biomass Renewable Sources Of Energy

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

Delivered Duty Paid Meaning Obligations Advantages And Disadvantages In 2022 Financial Management Deliver Duties

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

8 Pros And Cons Of Carbon Tax Brandongaille Com

The Benefit Of Freelancing Blogging Services Virtual Assistant Services Virtual Assistant

What Is Verbal Communication Advantages And Disadvantages Of Verbal Communication A Plus Topper What Is Verbal Communication Communication Intrapersonal

Carbon Tax Pros And Cons Economics Help

Blogengage Advantages And Disadvantages Of Sustainable Development Gavin2219 Sustainable Development Sustainability Education Sustainability

Advantages And Disadvantages Of Geothermal Energy Uses Benefits And Drawbacks Of Geothermal Energy Geothermal Energy Geothermal Renewable Sources Of Energy

Carbon Tax What Are The Pros And Cons Climateaction