ev charger tax credit 2020

The Inflation Reduction Act of 2022 Public Law 117-169 amended the Qualified Plug-in Electric Drive Motor Vehicle Credit IRC 30D now known as the Clean Vehicle. Up to 1000 state tax credit Local and Utility Incentives.

Electric Vehicle Tax Credits And Rebates Electric Car Incentives

Lets run the calculation for clarity.

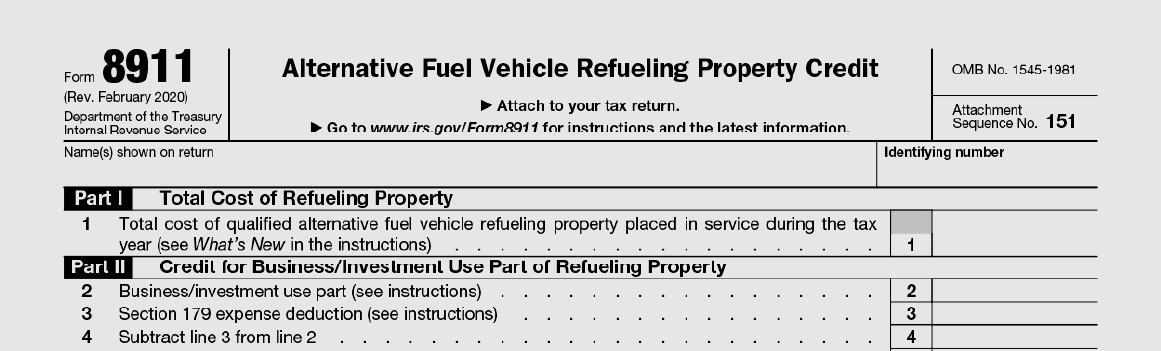

. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Credit for 5 kWh battery. A federal tax credit of 30 of the cost of installing EV charging equipment which had expired December 31 2016 has been retroactively extended through December 31 2020.

The AFITC is a time-limited EV charging tax credit. 2 days agoTaxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in your home after December 31 2021. Save up to 1000 on charging your EV at home.

Credit for every kWh over 5. 11 x 417 4587. However i cant find any evidence of this being valid past 123121.

A tax credit is also available for 50 of the equipment and labor costs for the purchase and installation of alternative fuel infrastructure on qualified AFV fueling property. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022.

Electric Vehicles Solar and Energy Storage. The AFITC Is Expiring at the End of 2020. It already expired once in 2016 but was extended by the government.

The credit amount will vary based on the capacity of. This is a one-time. The credit begins to phase out for a manufacturer when that manufacturer sells.

EV battery 16 kWh. Reduced Vehicle License Tax and carpool lane access. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

However i cant find any evidence of this being valid past 123121. Ev Home Charger Tax Credit 2020. Federal tax credit gives individuals 30 off a ChargePoint Home Flex electric vehicle charging station plus installation costs up.

A federal tax credit of 30 of the cost of installing ev charging equipment which had expired december 31 2016 has been retroactively extended through december 31 2020.

How To Get Illinois 4 000 Electric Vehicle Rebate Wbez Chicago

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Making The Most Of An Ev Charger Rebate And Incentives 365 Pronto

Federal Tax Credit For Ev Charging Stations Installation Extended

Beyond Bid Getting Ev Charging Plugged Into Reconciliation Third Way

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Buying An Ev Charging Station Future Energy Future Energy

Tax Credit For Electric Vehicle Chargers Enel X Way

Ev Charger Tax Credit 2022 Wattlogic

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Electric Vehicle Buyers Want Rebates Not Tax Credits Gw Today The George Washington University

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Beyond Bid Getting Ev Charging Plugged Into Reconciliation Third Way

Amazon Com Megear Skysword Level 1 Ev Charger 100 120v 16a 25ft Portable Evse Nema 5 15 Plug Electric Vehicle Charging Station Automotive

Electric Car Tax Credits What S Available Energysage

Amazon Com Chargepoint Home Flex Electric Vehicle Ev Charger Upto 50 Amp 240v Level 2 Wifi Enabled Evse Ul Listed Energy Star Nema 6 50 Plug Or Hardwired Indoor Outdoor 23 Foot Cable Automotive

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Government Incentives For Plug In Electric Vehicles Wikipedia